Vontier Corporation (NYSE: VNT)

Vontier Corporation (NYSE: VNT)

Vontier is a solid business with good management and a sound business model. Since being spun-off from the giant Fortive in late 2020, VNT has transitioned well into operating as an independent company. The business focuses on “mobility technology” and diagnostic and repair tools for the auto industry. With normalized earnings of around $450mm - $500mm, Vontier appears to be cheap at a market cap of $3.8b.

Mobility Tech

The mobility technology segment is a mix of one very good business, GVR, and two mediocre businesses with lots of runway for growth – Global Traffic Technologies and Teletrac Navman.

GVR (Gilbarco Veeder-Root) offers SaaS and retail solutions to the convenience store and fuel station industry. It provides fuel dispensers, POS systems, in-store software management, workflow management, environmental solutions, and other products. GVR serves over 260,000 retail fuel stations and has an installed base of over 690,000 pay-at-pump devices. The company is a leader in fuel retail solutions and faces limited competition on a global scale. These solutions also provide for high switching costs as customers grow dependent on the service and tend to find it inconvenient to try another product (if an alternative even exists). No company offers the same breadth of services that cover all operations – from payment transactions to in-store purchases and reserve fuel management. Having such a large installed base also gives GVR the opportunity to quickly scale any new product or service it develops. Given that many customers already have long-lasting relationships with the company, GVR can easily introduce new products to its customer base. Moreover, having a global network of convenience stores/ fuel stations means that the company can identify points of pain/ demand from its clients, and go on to develop products.

GTT and Teletrac Navman are still in their early development, but both have a long runway for growth.

Teletrac’s management has succeeded in turning the company around, and its recent TN360 (which offers AI-based fleet management) product has finally tipped the company towards profitability. Teletrac tracks over 480,000 vehicles for more than 40,000 companies, analyzing efficiency, workflow, equipment tracking, safety solutions, and more. Like with GVR, such a large customer base gives the company the opportunity to introduce and scale new products quickly, adding incremental product improvement and FCF. For instance, management is currently thinking about introducing logistics and supply chain solutions to help fleet managers better control costs and streamline operations.

GTT is present in over 90,000 intersections and has over 3,100 customers. It is a subscription based business that offers traffic and parking management as well as toll collections (think “Smart City”). The smart city industry is still in relatively early development but increasingly driver regulation as well as traffic congestion as vehicle ownership increases should prove as strong tailwinds for the company. GTT and Teletrac also work together to come up with unique products. For example, GTT’s Opticom (stoplight manager) combined with Telectrac’s 360 to form Opticom 360 – a solution that will allow fleet managers (ambulances, government vehicles, etc.) to have access to traffic flow and better coordinate their efforts.

Although mobility tech is still predominantly the sale of fuel dispensers and POS systems, it is gradually moving towards more of a SaaS-type business with highly recurring revenues. There is lots of room for logical product expansion through in-house development or bolt-on acquisitions, and the large installed base of GVR and the other companies provides for easier scaling at lower cost. Mobility Tech also generally benefits from increasing environmental, privacy, and safety regulation. For example, EMV has been a strong tailwind for GVR over these last years until its deadline in April of 2021. It essentially forced many of the convenience store and fuel station operators to upgrade their equipment to comply with the latest payment protection standards (due to increasing payment fraud at c-stores and f-stations). Operators had to install POS systems that read card chips and had other safety features. Over 80% of VNT’s customer base had to upgrade, which significantly increased backlog and provided for a strong tailwind in customer adoption. Environmental regulations also serve to boost demand as companies had to implement vapor recovery systems and fuel tracking to comply with regulations.

Diagnostic and Repair Tools

Like Mobility, DT has one solid business and one mediocre one that management claims is underearning.

Matco is one of the most recognized brands in the auto repair industry, being named a Top 500 Franchise by The Entrepreneur. Present in over 140,000 repair shops and owned by over 600,000 technicians, Matco has a strong brand and has grown consistently over the years. The repair industry is generally characterized by strong brand loyalty but intense competition. Technician’s tend to have a “preferred” set of tools from a certain brand, and generally don’t want to risk experimenting with any unfamiliar equipment. According to management, Matco is benefitting from two main trends: 1) lack of skilled auto technicians relative to demand and 2) increasingly more complex vehicles. I’d also add that, post-COVID, many vehicles are being reused and hence need more maintenance work. So, this lack of supply of technicians mixed with increasingly more complex vehicles that need more repair means that there is strong demand for new, more efficient D&R tools.

In order to adjust to this new environment, Matco has set up an e-commerce platform where technicians can place orders and get their equipment delivered to them. Matco also introduced new, user-friendly software for different skill-levels to allow technicians to do repair work in a more efficient manner. Other products include workflow management and financing for franchisees and buyers for their purchases. Matco does not “sell” its products, and instead distributes it to a base of over 1,800 franchisees who also pay the company royalty. Matco can continue organic growth through 1) continuing to increase its franchisee base, 2) implement new, more user-friendly products to meet market demand, and 3) enhance its e-commerce platform.

Hennessy sells wheel-service equipment. Like Matco, Hennessy generally enjoys customer loyalty and also benefits from increasing vehicle complexity. Its brands include Coats, Bada, Baseline, and Ammco. Management sees an opportunity to add products like vehicle diagnostics and digital workflow solutions (like it did with Matco). Hennessy does operate in a slightly more niche market, but doesn’t enjoy the same economies of scale or brand recognition.

Strategy

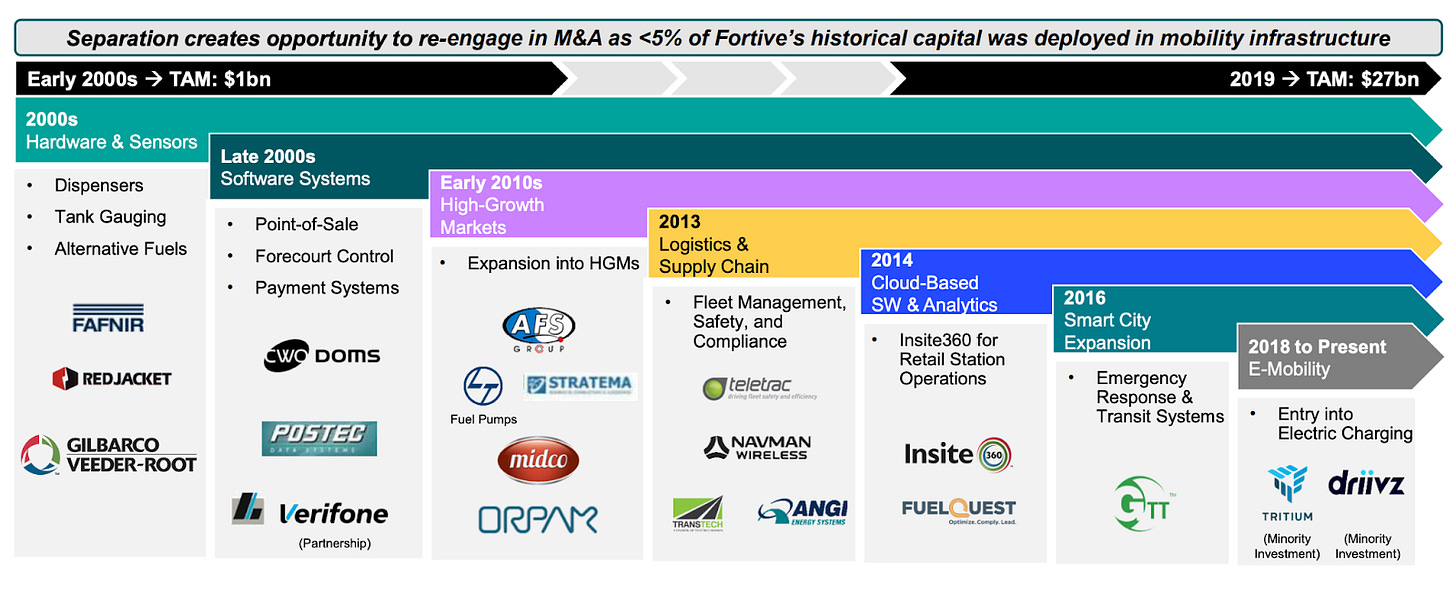

Mr. Morelli has mentioned that the company will prioritize M&A going forward. In fact, every part of Vontier has been built through acquisitions. Fortive acquired Veeder-Root in the 1980s, Matco and Hennessy in 1986, Red Jacket in 2000, Gilbarco in 2002, Gasboy in 2003, Gasboy in 2003, Navman Wireless in 2012, Orpak Systems in 2017, and others.

The company has a solid, disciplined M&A approach with a separate division dedicated to the process. Management has a hurdle rate of 10% ROIC and looks exclusively for complementary companies. Its recent acquisition of DRB is a good example. DRB is a market leading integrated technology provider of point of sale, workflow software, and control solutions to the car wash industry. It will develop as a standalone company/ division, and fits the company knowledge base + portfolio very well.

This, however, means that management isn’t going to go as heavy on dividends or share buybacks (although it did buy back a lot lately). Quality acquisitions are also generally hard to come by at a good price, although the company should not have much trouble achieving the 10% hurdle rate.

It also plans on making bolt-on acquisitions to develop its existing portfolio. It has historically done very well here, with acquisitions like Red Jacket, Gilbarco, and others providing for significant synergies and market expansion.

GVR itself, for example, has been built from a hardware provider to a strong portfolio of products and solutions which work together to drive demand and revenue.

I expect VNT to have no problem executing on its M&A strategy, which I assume is going to help the company move away from ICE and towards EV.

EV Threat

Although internal combustion engine vehicles are expected to remain 90% of the global car parc through 2030, it is a given (in my opinion) that EVs will become the norm for transport in the distant future. This, in turn, means that many of VNT’s offerings will become obsolete or see a significant cut in demand. From fuel dispensers to diagnostics and environmental solutions, a large chunk of the portfolio revolves around petroleum and ICE-vehicles.

However, I do think that Vontier can successfully transition given its ability to execute well on M&A, as well as its historic performance in adapting to changing market conditions. Its minor investments in Driivz and Tritium also give it a nice entry into the market and a way of analyzing the current environment through the investments. What’s more, given its huge customer base, I would say that VNT is even the strong favorite in successfully implementing EV solutions globally. If it does end up acquiring Tritium and Driivz, it can easily scale the offerings globally across its 260,000 + stations. It also has deep expertise in adding bolt-on acquisitions and further developing the products.

Although the transition might be tough, I expect it to execute well.

Why I Won’t Own Vontier

Vontier is a great company. Matco and GVR are wonderful businesses. The EMV headwind has scared the market and the EV threat continues to loom over the business. I actually think that VNT can pretty easily generate double-digit returns going forward. It’s trading at only 7-8x earnings and has seen stable historic, above-GDP growth. Mr. Morelli is also a great CEO, and the DNA of Danaher and Fortive could be seen in the execution of the business through its VBS system.

The balance sheet leaves more to be desired. With over $2b in net debt, VNT has little room for flexibility. Although a large part of the debt ($1.6b) has been used to pay Fortive, I still think the financial position could be better. The large $1.6b+ goodwill doesn’t help either. Yes, there are intangible assets like brand and workforce that we can try to calculate, but these bottom line is that the financial position doesn’t leave me comfortable investing.

Although I like the DRB acquisition, I find it hard to make sense of the price paid for the company. With $170mm in revenue, and mid-20% operating margins, DRB will (conservatively) earn about $31mm after-tax. At a purchase price of $965mm, VNT paid 31x earnings. Even if we subtract the deferred tax asset of $130mm, we still get 26x for a company that’s expected to grow only high single-digits going forward. Sure, there are synergies, but they aren’t anything meaningful.

My main issue, however, is simply that I can’t make a confident bet on the EV transition. With $2b in debt, VNT doesn’t have that much room for rapid expansion in a market that’s relatively nascent. Although it enjoys solid competitive advantages now, it’s not a given that these will be retained in the transition. I also don’t know how FCF or earnings will look like in the LT with the impact of EMV, and Hennessy, GTT, and Teletrac Navman are still in their early stages where we can’t really predict how they’ll perform in the future.

This is one of those weird cases, sort of like with Turning Point Brands, where the company is great but just not good enough and a bit outside of my circle of competence and comfort zone to be able to invest confidently. It’s definitely something I’d suggest looking at for anyone looking for unique auto or EV exposure, and I’ll keep tracking the company to see how it does. I’m sure it’ll do just fine, I just can’t make a comfortable enough bet.

Ultimately, I just want a compounder and at 4-5% growth, it will be hard for VNT to produce 15%+ returns for the next 10 or 20 years. Comparing VNT to something like Kaspi or Alimentation also make it less attractive, and in the recent market sell-off I think there are simply better opportunities out there.