Ten Square Games

TSG is one of Poland’s leading mobile game publishers, with over 56mm downloads and 200 published games. It is the 3rd largest gamedev in Poland, and was founded in 2011 in Wroclaw University.

I don’t want to go too much into the details of the company as they are not very important to this post. Olivier Marz (@ReturnsJourney) has already done a fantastic write-up that you should check you:

TSG is very much a continuation of my research into Tencent’s gaming division. I thought that if I can mimic Tencent in acquiring a basket of high-quality studios with promising IPs/ “game models,” a dominant market position, and strong human capital, I can do relatively well even if some of the studios in the basket fail to produce strong results.

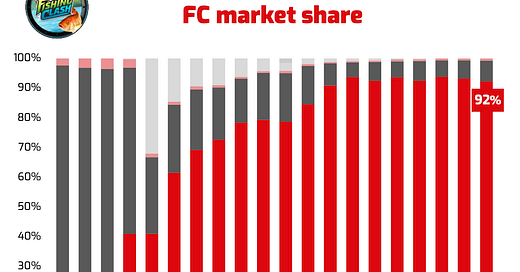

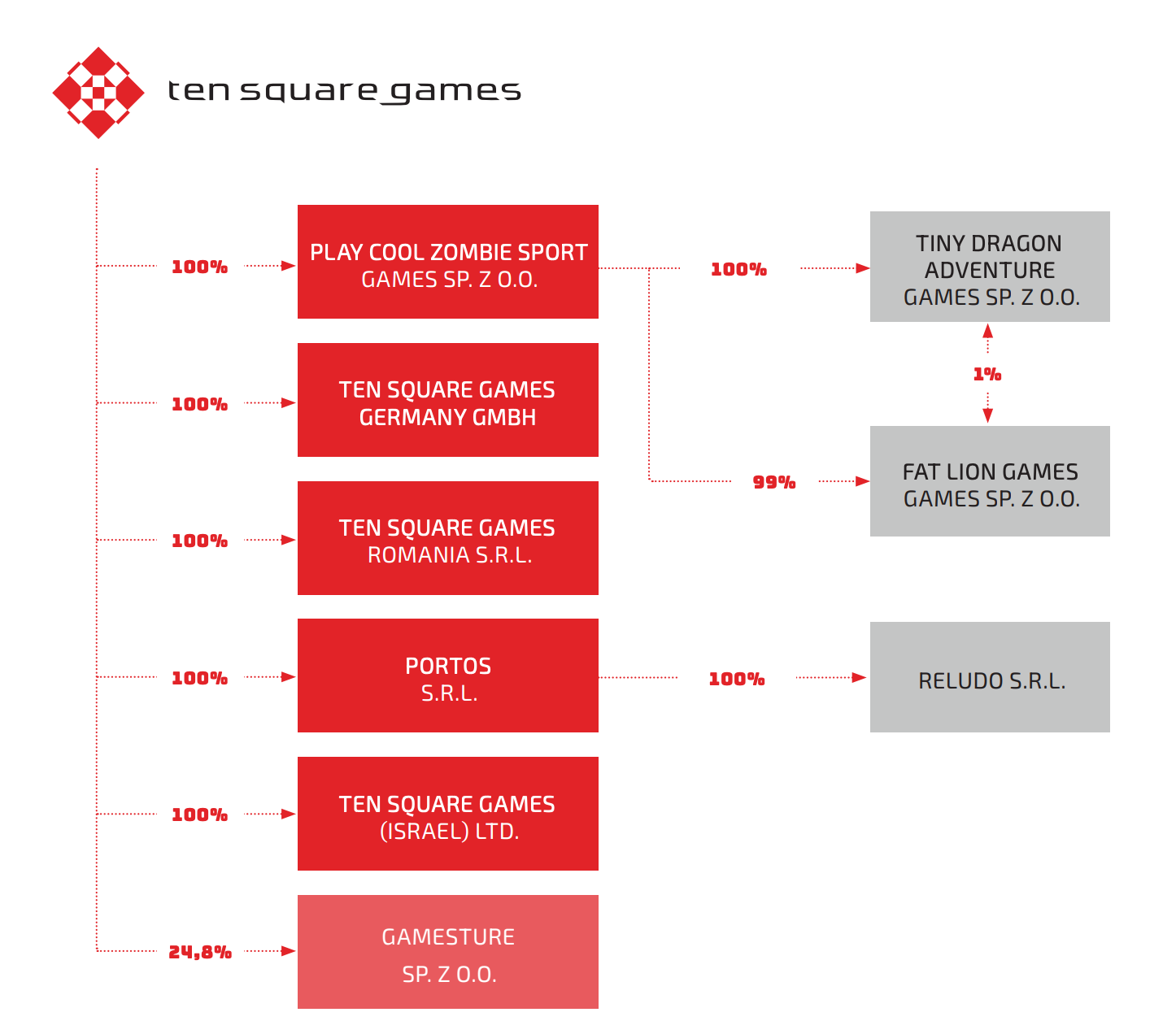

TSG was the first one I decided to look at. It has a dominant market position in the fishing and hunting genre (almost 90% market share in both) with its two home-run games “Fishing Clash” and “Hunting Clash.” The company exclusively focuses on mobile F2P games and has been aggressively expanding its human capital both locally and internationally by opening up studios in Bucharest, Berlin, and Israel.

Based on Tencent, I see human capital as one of the most important factors in the gamedev area. There are 1) no barriers to entry, 2) no unique technology a studio can utilize to gain an edge over competitors, and 3) no significant switching costs. Human capital is literally what the whole business is centered around, and a studio with higher-quality developers will likely do better over the long-term. TSG’s opening of centers in Israel, Bucharest, and Berlin highlights their focus on human resource development, which is initially why I decided to dive deep into the business.

Good developers lead to development of strong IPs (and something I call “game models” which I will touch on later) which form the bedrock of a competitive advantage and sustainable FCF generation for a studio. Tencent’s ability to do so well in the industry stemmed partially from its ability to spot studios with a proven track record of developing a strong franchise and maintaining its following / “relevancy.” Strong IPs allow for a 1) longer game life-cycle, 2) higher monetization, and 3) ability to create spin-offs that will enjoy strong demand.

What I found interesting about a mobile-game developer like TSG to warrant writing about was the economics of the business. The development process for a mobile game is both cheaper and quicker than development of console / PC games. Hunting Clash and Fishing Clash were developed for pennies relative to what they generate in FCF.

Here’s a simple example. Undead Clash (a continuation of TSG’s “Clash” games) has a capitalized development cost of roughly PLN 8mm. This is a game that is in its early testing phase, with much of the development already completed (game expected to release in Q4 of this year). Let’s assume that the total cost of developing the game (not including marketing costs) is going to be roughly PLN 10-12mm. At a PLN 12mm development cost, TSG can afford to develop (not fully introduced, as that would also involve marketing) roughly 10 games just from this year’s FCF (PLN 135mm). Of course, it isn’t actually going to go all-in on game development, especially given its strategy of expanding offices geographically and rising personnel costs, but this just shows the weird economics of the business. If a game manages to generate even ½ of what Hunting Clash makes in FCF, we would get an additional ~ PLN 10-11mm in FCF on a market capitalization of ~ PLN 690mm.

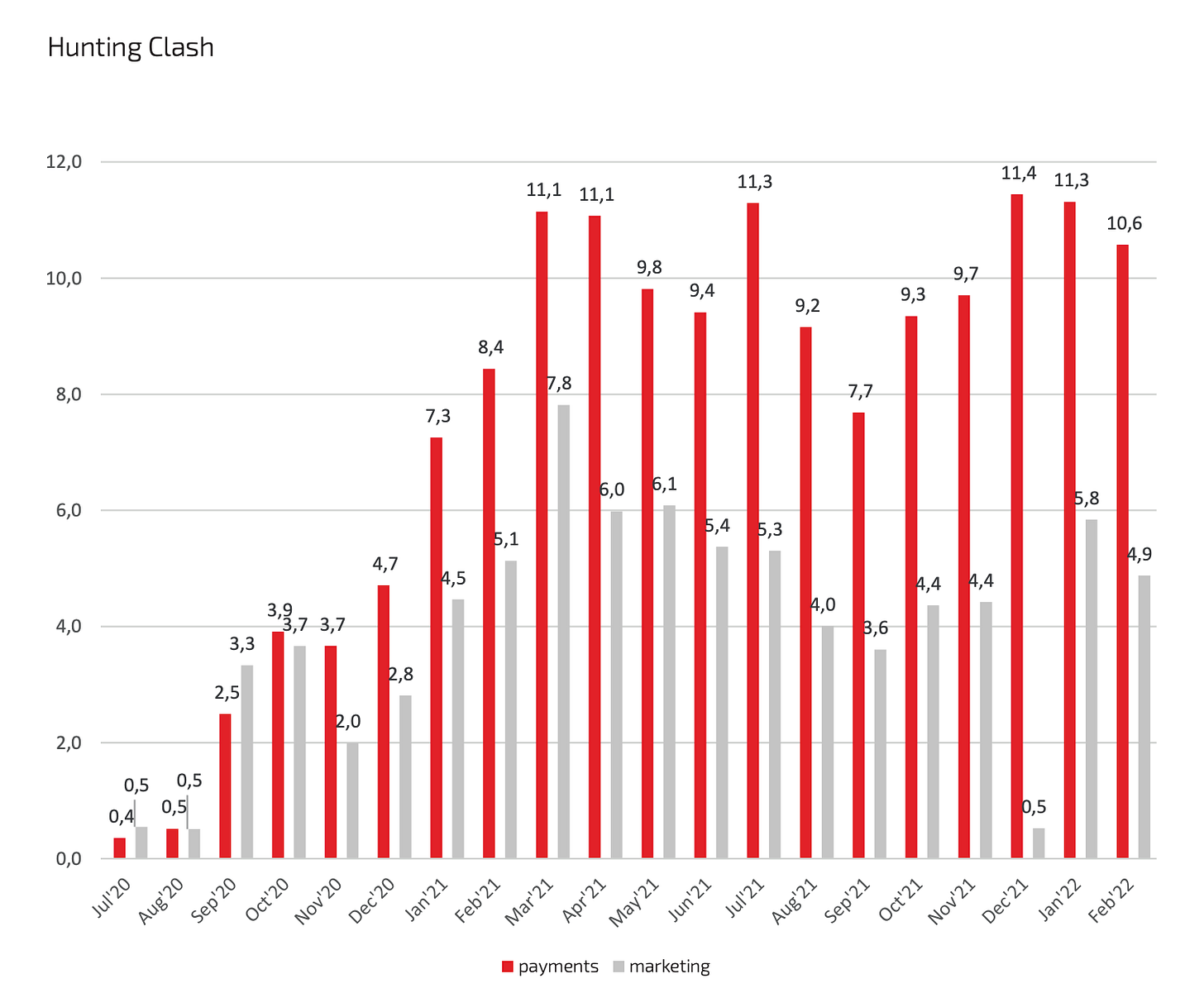

Marketing spend, after the game stabilizes and there’s a long enough time-frame to be deemed viable, then becomes an investment (at least partially). For instance, during Hunting Clash’s first full year, TSG spent a total of PLN 57mm on marketing to generate bookings of roughly PLN 116mm. Assuming the lower-end of the average FCF margin of around 20%, we get ~ PLN 23mm in FCF in the first full year of operations from a cumulative investment (including marketing costs and assuming similar development costs between Undead Clash and Hunting Clash) of around PLN 70mm (you do the math!). Even if Hunting Clash was twice as expensive to develop as Undead Clash (which I don’t think is likely), we get a total investment of around PLN 82mm to generate PLN 23mm in FCF – spectacular returns. It is, however, important to note that advertising costs were substantially lower during COVID which management used favorably. Such low costs likely won’t exist going forward and returns on marketing aren’t going to be as great (m.costs will likely be lower, but so will bookings). This, however, does not necessarily hurt the bottom line as hard as one may initially think.

Yes, Hunting Clash was a huge success, but here is where I see another advantage come in. As a developer releases more successful games, they get progressively better at identifying and replicating what works. TSG has developed a “Clash” model that, based on their first two games, is something that can deliver decent performance. Now, sort of like with a franchise, they can just milk the game model by applying different spins to it (like they are doing with Undead).

A good example of this is Supercell. After Clash of Clans, Clash Royale, Hay Day, Boom Beach, and other games, the team has – more or less – a framework for the types of games it wants to develop. Brawl Stars is a product of this pattern recognition.

Developing and releasing a game has, by nature, an uncertain ROI. Developers never know exactly how successful (or unsuccessful) the game will be until they release it and let people try it out. This is why most companies who are fortunate enough to own a franchise IP mostly focus on developing games under those banners. We rarely see EA or Activision come up with some unique game concept – because they don’t have to. Why risk the uncertainty of a new game’s ROI if they can fairly easily get an excellent return by making a spin-off of an existing franchise? One has to only count the amount of Call of Duty and FIFA games to see how much these developers rely on these mega-popular IPs.

Does TSG have an IP like that? No. It does, however, have a model – much like Supercell – that gives it a slightly greater chance of developing a successful game. It is also getting increasingly better at maintaining their games and introducing new content.

Given the mentioned economics, TSG can comfortably develop up to 3 games A YEAR, even if their FCF is cut in half (and make additional investments on top of that). Moreover, development costs can stretch over a period of ~2 years, meaning that the developer can technically account for marketing as well.

It is actually fairly hard for the game to be FCF negative unless management chooses to take an aggressive marketing path. The only other significant cost is commission fees (payment processing + commission to Apple and Google) and salaries (small % of bookings), both of which leave a comfortable profit margin. It is, for example, literally impossible for the game to be FCF negative off of commission costs alone (unless accounting for bookings by the marketplaces somehow radically changes to some absurd standards). Management can then assess whether the game warrants a significant marketing investment, or whether they should go ahead with “maintenance” marketing. Either way, the economics are superb in my opinion.

If even one of these games reaches the scale and profitability of Hunting Clash, we are bound to make significant money. If the game reaches the heights of Fishing Clash (which in my opinion is fairly unlikely, but possible) we would be looking at a multi-bagger!

The valuation makes things even sweeter. At a market cap of around PLN 690mm (with PLN 149mm in cash), TSG can just maintain its current games for a couple of years to justify making an investment. This year’s FCF was roughly PLN 135mm. Even if it is cut in half to PLN 68mm, we get a ~10% yield with a strong pipeline of games that, cumulatively, can generate as much as PLN 5mm - 20mm a year.

The problem, however, is that while a basket of such developers helps diversify and stabilize the upside, we get no protection from the downside. Especially in the mobile gaming market, sustainable competitive advantages are hard to come by. With the lack of substantial barriers to entry, the earning power of a developer like TSG is highly unstable and unpredictable over the long-term. Mobile games can explode within months or even weeks, but they can die down just as quickly. Although it might be worthwhile to try and identify developers who are unlikely to face such declines due to excellent IPs, I find that most are too richly priced to warrant taking a look at.

I know (and have to assume) that 1) I have no idea what Fishing Clash and Hunting Clash will look like in 3-5 years and 2) I have no guarantee that any of the games the company develops or acquires will see similar commercial success. While the risk-reward seems attractive, I think one has to primarily look at the downside first. In a case like TSG, it has the potential to be substantial and unpredictable. Permanent loss of capital is very much a possibility here.

Onto the next one.

Recently landed on your substack. I'm really grateful for investment antithesis that contain the whole process. I'm also quite into video games and agree that downside protection is paramount and often simply inexistent in most studios.