This is not an actionable investment idea, although maybe some arb play still exists here. Instead, this is an account of my first arb trade, and one that has as of today worked out nicely (although separating skill from luck here is impossible). This has been an interesting learning experience so I want it to be on the blog.

BWI is a manufacturer and distributor of skincare, nutritional supplement, and wellness products. ~50% of its revenue comes from China. The business itself is not important. BWI was founded by Dora Hoan Beng Mui (http://www.dorahoan.com/profile.html) and Doreen Tan Nee Moi. Their background is also not important other than collectively they, their vehicle (D2 Investments) and their related parties control ~65% of the business.

Rough timeline:

February 18, 2019 – Business Times publishes an article highlighting concerns about BWI’s business model in China (fabricated sales, unlikely existence of reported franchisees, legality of distribution model).

February 23, 2019 – BWI issues response to BT article

March 19, 2019 – BWI appoints PwC as an independent reviewer to address issues raised in the BT article

April 24, 2019 – Bonitas Research, an activist short seller, publishes a short report alleging that, among other things, BWI was effectively running a pyramid scheme in China and fabricated SGD 31mm in sales.

May 9, 2019 – BWI issues announcement to refute the Bonitas Report

Valiant Varriors, another short seller, releases another report shortly after that suggests that the legal person and shareholder of Changsha Best, the main distributor of BWI’s products in China, appears to be the brother-in-law of the Group’s CEO and managing Director, Dora Hoan. SGX RegCo asks BWI to provide information on Changsha Best and whether the allegations are true.

BWI confirms that Changsha Best is an independent 3P and none of BWI related parties has any direct or indirect shareholding interests

May 13, 2019 – Notice of Compliance from SGX RegCo

BWI confirms that Koh Kim Chuan is the brother-in-law of Group’s CEO and managing Director

Revelation of the relationship between Changsha and BWI raises serious concerns about veracity of China sales unducted under the Export Model

Due to regulatory concerns, SGX imposed a trading halt on BWI shares. BWI applied several times for a trading resumption, but SGX RegCo refused, asking management to address issues with its business model in China, partially through an independent legal opinion. BWI in turn decided to proceed with switching the distribution model, and hence resolving SGX RegCo’s issues, however China's MOFCOM would not resume accepting the relevant applications. BWI stock was hence stuck in a trading freeze, and shareholders were stuck with what was essentially dead / frozen capital.

On September 15, 2021, BWI’s auditor, EY, issued a disclaimer of opinion citing issues with BWI’s business model in China, the relationship with BWI's Import Agents and Marketing Agent, and the classification of payments to promotional companies

In October 2021, BWI proposed a change of auditors, switching to Nexia TS Public Accounting. Management cites “ongoing efforts to manage its overall business costs and expenses amidst the challenging business climate.” A month later EY is out and Nexia is in.

On November 1, 2021, BWI consults with SGX RegCo and announces that a trading suspension will remain until it is able to transition to a direct selling model in China. MOFCOM has still not resumed taking applications for direct selling licenses. BWI is essentially in a stalemate – SGX RegCo is not letting it trade again unless it gets the right license, but the relevant authority in China is not accepting applications for such licenses. In light of this, BWI management suggests in a press release that it might be “appropriate to consider a delisting and will be exploring all feasible options to achieve the same, including a delisting under Rule 1309 of the Listing Manual.”

Here, in effect, is likely where the controlling shareholders see a very clear path toward taking the co private at a meaningful discount. The shares have been banned from open-market trading for years, the public market reputation of BWI and its management has been permanently impaired, and existing minority shareholders have been stuck with dead capital for years and are willing to cash out at a discount.

BWI management announces a series of off-market equal access buybacks. In two large buybacks, one on December 31, 2021 and another on April 26, 2022, management acquired ~20% of outstanding shares at a 20%+ discount to where the shares last traded prior to the trading freeze.

On top of this, management begins hoarding cash (from SGD 241mm in FY19 to SGD 608.1mm in FY23). When criticized by shareholders, BWI’s management cited China’s macro uncertainty, M&A opportunities, stock market volatility, and the need to provide shareholders with liquidity through buybacks. None of these are actual reasons, and BWI’s fairly capital-light model needs nowhere near the amount of cash BWI holds on its balance sheet.

Whether by intention or not, management has actually played this beautifully (for themselves). They turned a rough spot (short sellers, trading halt, fraud allegations, regulatory scrutiny) into a situation where they are able to (1) hoard cash over a 4 year period, (2) use this cash to opportunistically acquire shares from minority shareholders at a meaningful discount to both market and intrinsic values, and (3) set themselves up to take BWI private once the time is right. Of course, legacy BWI shareholders have been left holding the bag.

On March 22, 2024, with ~$600mm in net cash on the balance sheet and an enterprise value of sub $200mm, management announced an intention to delist through a share capital reduction (SCR). Other than the founders and their related parties, all remaining shareholders will have their shares acquired and canceled by BWI in exchange for a cash offer. BWI was #966 on my waitlist of names and, purely by accident, I began working on it around March 23-24. I quickly passed on the business but stumbled upon BT’s article citing management’s intention to delist.

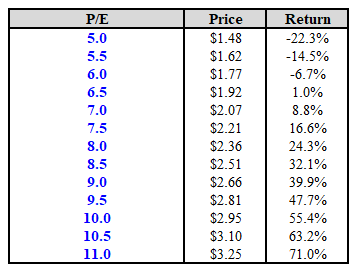

A quick two-day read of their announcements and releases since 2019, a look into Singapore’s SCR regulations (most of which consist of getting approval from non-proposing shareholders and the High Court), and a simple model suggest that the offer price was likely to be a good bit higher than then’s price of ~$1.90 per share.

As far as I know, this is not the standard arb situation because even though a deal is technically announced, and is very likely to go through given the backstory mentioned above, we do not get an outright price in the event that a deal does take place. However, a quick model shows us that BWI:

Has been able to grow top line double-digits historically

Maintains healthy, 30%+ EBIT margins

Has previously been willing to pay out dividends and has recently been buying back meaningful stock (although likely not for the right reasons)

Has 600mm+ in cash vs roughly half of that needed to buy out minority shareholders

Is trading at ~6.4x FY23 earnings

Has management that is incredibly incentivized for the deal to go through

BWI, as required by regulation, appointed an IFA, in this case Evolve Capital Advisory, to do work on what a “fair” offer price for exiting shareholders would look like.

Our downside is BWI trading back to $1.75 (price before SCR announcement). Our upside can be as high as $3+ per share, and more likely around $2.50 - $2.70 per share based on available cash, comps, and historic valuation.

So while we do not know the exact price we are likely to be offered, we do know that we likely see good upside from current prices. What’s more, controlling shareholders will not get to vote on the SCR proposal, and hence if the price is inadequate then the remaining 35% of shareholders will likely simply veto it.

Moreover, a quick search of recent SCR offers on the SGX (although none had the same setup as BWI) suggested that the general policy was to offer a small premium to the average price over X trading days. So while our upside might not be meaningful, we still make money in the vast majority of outcomes given that I think the SCR has a very high chance of going through.

The other caveat is that we make money when the offer price is announced (i.e. when the Exit Offer is published and the market has a hard price around which to model). We think that the offered price is going to be higher than the current market price, but more importantly we can be virtually certain that an Exit Offer is going to come at some point. So it’s not necessarily a question of whether the SCR itself is going to go through, but rather when the Exit Offer is going to come and what the offer price is going to be.

Management is clearly incentivized to go through with the deal, but unlike during the trading halt, the bargaining power is more balanced between controlling and minority shareholders in this scenario. Hence the need to offer an attractive price.

Ironically, my $2.47 estimate from last week is fairly close to the $2.50 that BWI announced today it is offering to exiting shareholders. I have not touched my model since this weekend. In today’s release, BWI announced that it will capitalize part of its retained earnings and apply them to the SCR. It is preparing an EGM circular to be released in due course, convening shareholders to vote on the retained earnings capitalization and on the SCR itself. When BWI gets approval from its non-proposing shareholders, it will have to seek approval from the High Court (based on my research this has a very high chance of going through), and finally file with ACRA a copy of the approving court order. Once a copy has been filed, the SCR can take place.

I’m not sure whether this was luck or skill (well, certainly luck in starting to work on BWI when I did). I’m leaning more toward luck given that this is my first arb rodeo, but as a whole the process makes sense. Understand the backstory, read the filings and releases super, super carefully, understand the incentives, do the math, and bet when you think the odds are meaningfully mispriced. Because this was my first time I did not bet big (something like 90 bps of the portfolio) but I can see how this can move the needle when done frequently and in size. And of course I have the benefit of hindsight when writing all of this.

Anyway that’s it, I’d love to know what people think about this.

Nicely done and thanks for sharing the story! Timing was lucky, but the process, reasoning and execution were solid!

Profitable financially, another model added to the archive, and more positive reinforcement that turning over many rocks will unearth some vibrant opportunities. Few are following this approach.

Very insightful read as always